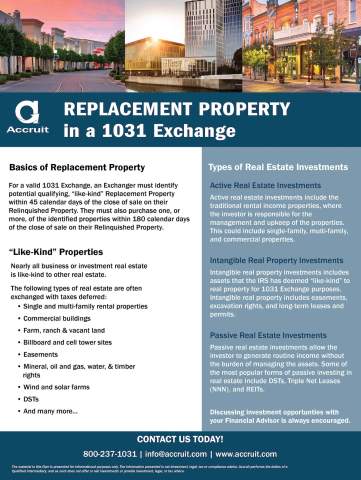

Replacement Property in a 1031 Exchange

For a valid Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange , an Exchanger must identify potential qualifying, “like-kind” Replacement Property within 45 calendar days of the close of sale on their Relinquished Property. They must also purchase one, or more, of the identified properties within 180 calendar days of the close of sale on their Relinquished Property.

There are misconceptions that "like-kind" means you much exchange an apartment building for another apartment building, that is not case. Nearly all business or investment use real estate is "like-kind" to one another. This flyer provides a deeper look into the Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property , as well as the different types of real estate investments including active and passive.