BLOG

Are 1031 Reverse Tax Deferred Exchanges of Real Estate Approved by the IRS?

While Reverse Exchanges have been safe-guarded since 2000 there is still much confusion in the marketplace as to whether or not they are approved by the IRS. Let's revisit the article below in which we cover frequently asked questions about Reverse Exchanges and discuss the history and evolution of them.

Real estate owners often receive conflicting advice about whether reverse tax deferred exchanges are legitimate tax strategies pre-approved as to structure by the IRS. In fact, reverse tax deferred exchanges have a long history and continue to be a valuable tool for owners of real estate who hold property for investment or business purposes. Here are some of the questions that frequently come up and speak to the evolution of how reverse exchanges of real estate came to be approved. We'll close this post with a look at the two approved structures in place today.

What is a 1031 Reverse Exchange?

A reverse exchange refers to the sequence of a taxpayer’s sale of relinquished property and the purchase of replacement property. When circumstances require a taxpayer to acquire replacement property prior to the sale of relinquished property, that situation is known generally as a “reverse exchange” fact pattern. Without further planning, the taxpayer’s direct purchase of the replacement property prior to the sale of the relinquished property, sometimes referred to as a “pure reverse” exchange is not approved by the IRS. The ability to do a reverse exchange requires a taxpayer to structure the transaction in a manner providing for the taxpayer to sell the relinquished property before acquiring the replacement property. In fact, the use of the term “reverse exchange” is a bit of a misnomer since the solution to deal with a reverse exchange fact pattern requires the sequence of sale and purchase to be accomplished with non-reverse timing. There are a couple of ways that this can be accomplished.

Do the Internal Revenue Service Regulations: IRC§1031 Allow for Reverse Exchanges?

Not specifically. After the landmark legal decision in the Starker case and the 1991 Treasury Regulations that followed, exchanges became a lot easier to complete and therefore much more popular than before. For the same reasons, the desire for taxpayers to complete reverse exchanges became much more popular at the same time. In fact, during the comment period between May of 1990 and April of 1991 regarding the proposed regulations governing conventional forward exchanges (see Internal Revenue Service Regulations: IRC§1031), many persons requested the IRS to include guidelines for completing a reverse exchange at the same time. In the preamble to those final regulations, however, the Treasury Department declined to do so stating:

“After reviewing the comments and the applicable law, the Service has determined that the deferred exchange rules of Section 1031(a)(3) do not apply to reverse-Starker transactions… however the Service will continue to study the applicability of the general rule of 1031(a)(1) to these transactions.”

Does the IRS Revenue Procedure 2000-37 Allow for Reverse Exchanges?

Yes. During the period from 1991 through 2000, many professional advisors structured reverse exchanges without the benefit of a “safe harbor” set forth by the IRS. Fortunately, this uncertainty became clarified in September of 2000 with the issuance of Revenue Procedure 2000-37 (Rev. Proc.). Basically, the Rev. Proc. suggested that an accommodating party could acquire the replacement property on behalf of the taxpayer and hold it for up to 180 days (shorter in some cases) allowing the taxpayer time to sell the relinquished property and immediately acquire the replacement property from the accommodating party. Alternatively, the taxpayer could arrange for an accommodating party to acquire the relinquished property from the taxpayer, allowing the taxpayer to immediately acquire the replacement property...provided however, that the taxpayer found a bona fide buyer to acquire the property from the accommodator within 180 days (shorter in some cases). Either of these steps would allow the taxpayer to effectively acquire the new property prior to the sale of the old property through an IRS approved reverse exchange structure.

What is an EAT in a Reverse Exchange?

The Rev. Proc. referred to the accommodating party as an “Exchange Accommodation Titleholder”, which is currently often referred to as an “EAT”. There are many companies that provide conventional forward exchange services (as a qualified intermediary) and a more limited number of those companies are also set up to provide EAT services. The practice of holding title to a property on behalf of a taxpayer is often referred to as “parking” title to the property with the EAT. For the mutual benefit of the taxpayer and the EAT, it is customary for the EAT to take title to the property using a special purpose entity, usually a limited liability company (“LLC”). This insulates each separate client’s reverse exchange that is being facilitated by the EAT from other clients’ transactions and from the affairs of the exchange company acting as the member of the EAT.

Today's IRS Approved Reverse Exchange Structures

1. Parking the Replacement Property

The reverse exchange Rev. Proc. requires the taxpayer and EAT to enter into an overarching document referred to as a Qualified Exchange Accommodation Agreement (“QEAA”) describing the transaction, the relationship between the parties and reciting certain required terms.

- Usually the taxpayer will already be under contract with the buyer prior to contacting the EAT in regard to the reverse exchange. To shift the purchase over to the EAT, there is a simple assignment document assigning the purchase contract from the taxpayer to the EAT (Note that this assignment should not be confused with the assignment of rights to the Qualified Intermediary that takes place in a forward exchange.).

- The property acquisition financing on behalf of the EAT is either provided by the taxpayer or the taxpayer’s relationship lender, or a combination of both. It is customary for the EAT to issue a Note and some kind of security interest such as a mortgage or a pledge of the membership interest in the limited liability company to the lender(s).

- To avoid dealing with any property tenants, the EAT will typically enter into a Master Lease with the taxpayer so that the taxpayer can act as lessor in relation to the tenants. This also puts the rental income into the taxpayers hand and not in the hands of the EAT. The EAT simply wants to receive its fee. The Rev. Proc. does not require the lease or loan to be arm’s length.

- In addition to the QEAA, the parties typically enter into some kind of contract providing for the transfer of the property, or the membership in the LLC, to the taxpayer. This takes place immediately after the taxpayer’s sale of the relinquished property.

- Last, depending upon the type of property being parked, there is typically a Phase One environmental report or simply an environmental indemnification agreement between the parties.

To recap, the applicable documents generally are as follows:

- Qualified Exchange Accommodation Agreement

- Assignment of Purchase Contract

- Non-Recourse Promissory Note

- Mortgage, Deed of Trust or Pledge Agreement of Membership Interest

- Master Lease

- Limited Liability Company Sale Agreement

- Environmental Indemnity Agreement

Final Step: Entering into a reverse exchange with an EAT does not remove the necessity of doing a conventional forward exchange of the relinquished property for the replacement property. Rather, it buys the taxpayer time to sell the relinquished property by arranging for the EAT to acquire the replacement property from the seller and to park it. The proceeds from the sale of the relinquished property are used to acquire the property from the EAT and the EAT uses those funds to pay back any prior loans made to the EAT for the original acquisition of the replacement property.

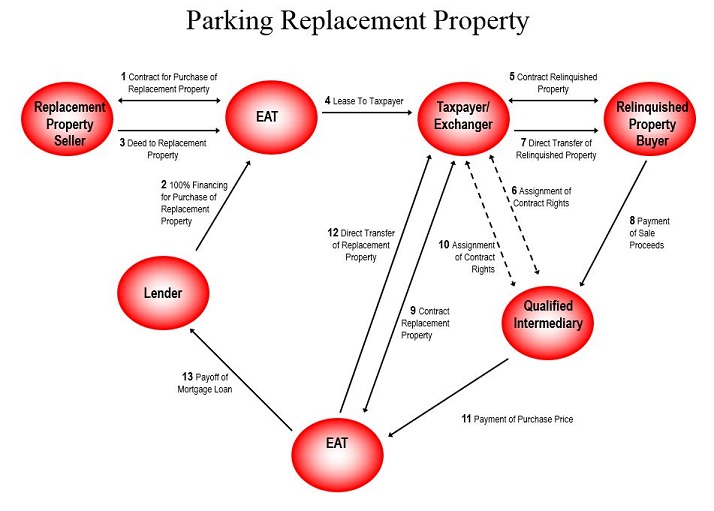

A reverse exchange parking the replacement property combined with a forward exchange looks something like the following:

2. Parking the Relinquished Property

Parking the relinquished property entails similar documentation to that of a replacement property parking arrangement. Conceptually, this arrangement is no different than a white knight showing up on the taxpayer’s doorstep to buy her property on the eve of the replacement property acquisition.

- Per the Rev. Proc. an overarching agreement must be entered into between the taxpayer and the EAT known as the QEAA.

- There will be a contract between the taxpayer and the EAT providing for the EAT’s purchase of the relinquished property.

- Generally if that property has debt on it, the EAT can acquire the property subject to the debt allowing for the property to be purchased for the amount of the taxpayer’s equity. That equity amount can be acquired through a bank loan or a direct loan from the taxpayer to the EAT. Any amount lent to the EAT will be used immediately by the EAT to acquire the property and the amount of equity paid goes into the taxpayer’s forward exchange account.

- There is a Note and a security instrument reflecting the amount lent to the EAT.

- A Master Lease allows for the taxpayer to deal directly with the tenants.

- Depending upon the type of property, there may be a requirement for a Phase One Environmental Audit or an environment indemnity agreement.

- Last, there may be some type of surety document which will provide for the taxpayer to be responsible for the representations and warranties made to the ultimate buyer of the relinquished property upon sale to that party by the EAT.

- When the relinquished property is sold by the EAT to a permanent buyer, the funds received by the EAT are used to pay back any loans originally made to the EAT as well as any debt that the EAT acquired the property subject to.

To park the relinquished property, the applicable documents generally are as follows:

- Qualified Exchange Accommodation Agreement

- Agreement for the Purchase of the Relinquished Property

- Non-Recourse Promissory Note

- Mortgage, Deed of Trust or Pledge Agreement of Membership Interest

- Master Lease

- Environmental Indemnity Agreement

- Surety Instrument

Final Step: Entering into a reverse exchange with an EAT does not remove the necessity of doing a conventional forward exchange of the relinquished property for the replacement property. Rather, it buys the taxpayer time to sell the relinquished property by transferring that property to the EAT, thereby triggering a sale of that property, allowing the taxpayer to acquire the replacement property on a non-reverse basis and taking up to six months (shorter in some cases) to find a permanent buyer.

A reverse exchange parking the relinquished property combined with a forward exchange looks something like the following:

Determining which Property to Park

When parking the replacement property the amount needed to acquire that property is a sum certain. However, when parking the relinquished property, it is often sold by the taxpayer to the EAT for a best guess of value. Inevitably, the actual amount later received by a permanent buyer will deviate up or down. So, when parking the relinquished property adjustments have to be made to deal with these deviations. So all things being equal, usually the replacement property gets parked. There are some factors which, when present, may suggest parking the relinquished property to be advantageous:

- The value of the relinquished property is much less than the replacement property so that the loan to the EAT is easy to attain

- The replacement property may involve special financing such as a Tax Increment Financing (TIF) or a Small Business Administration (SBA) loan which requires the taxpayer to be the borrower

- The replacement property may have some environmental issues which might involve some remediation of the issue

Updated 2.15.2022.