BLOG

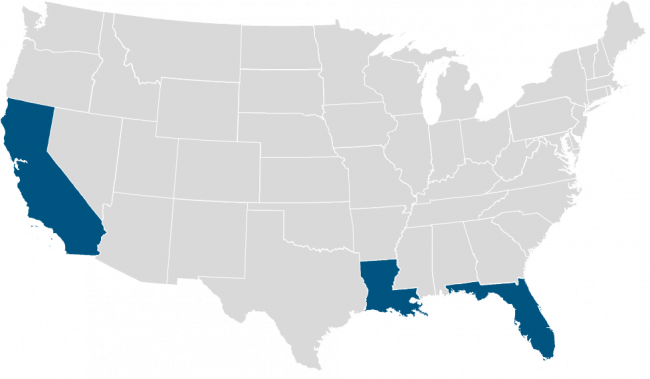

Extensions for Disaster Areas announced in California, Florida and Louisiana

Accruit has previously provided a summary of the rules pertaining to extensions of exchange transactions due to federally declared disasters.

The IRS has recently issued extensions for Section 1031 filing deadlines related to real estate located within certain counties in California, Florida, and Louisiana.

In California, the IRS issued extensions for Fresno, Los Angeles, Madera, Mendocino, Napa, San Bernardino, San Diego, Shasta, Siskiyou, and Sonoma counties for wildfires that began on September 4, 2020.

In Florida, the IRS issued extensions Bay, Escambia, Okaloosa, Santa Rosa, and Walton counties for hurricane Salley that began on September 14, 2020.

In Louisiana, the IRS issued extensions for Acadia, Beauregard, Calcasieu, Cameron, Jefferson Davis, Lafayette, Rapides, St. Landry, St. Martin and Vermilion parishes for hurricane Delta that began on October 6, 2020. Extensions were also issued for Acadia, Allen, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Cameron, Catahoula, Claiborne, Evangeline, Grant, Jackson, Jefferson Davis, Lafayette, La Salle, Lincoln, Morehouse, Natchitoches, Ouachita, Pointe Coupee, Rapides, Sabine, St. Landry, St. Martin, St. Mary, Union, Vermilion, Vernon, Webster, West Feliciana, and Winn parishes for hurricane Laura that began on August 22, 2020.

Accruit suggests that affected taxpayers consult with their tax and legal professionals as well as confirm on IRS website for any updates.