BLOG

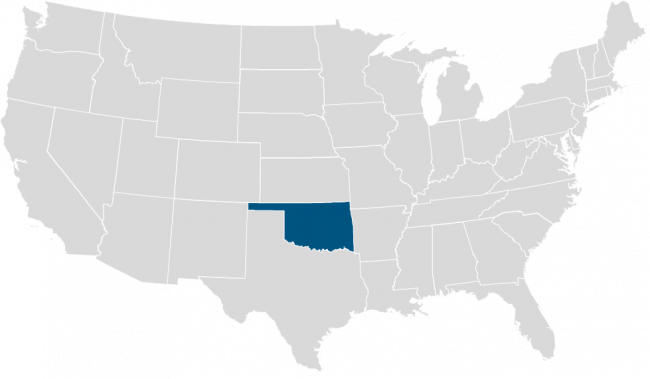

Extensions for Disaster Areas announced in Oklahoma

Accruit has previously provided a summary of the rules pertaining to extensions of exchange transactions due to federally declared disasters.

The IRS issued extensions for all 77 Oklahoma counties for victims of the severe winter storms that began on February 11, 2021.

The extensions were issued on February 25, 2021 for various deadlines. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. Certain deadlines falling on or after February 8, 2021, and before June 15, 2021 are postponed through June 15, 2021. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Taxpayers also have until June 15 to make 2020 IRA contributions. This extension also includes like-kind exchanges.

Accruit suggests that affected taxpayers consult with their tax and legal professionals as well as confirm on IRS website for any updates.