BLOG

Five Years of 100% Expensing Not Worth Repeal of Like-Kind Exchanges

The new tax bill unveiled today by House Republicans proposes to repeal like-kind exchanges for personal property. In its place, the bill provides for 100% expensing of property, however this provision is only temporary, sun-setting after five years. 100% expensing may be extended, as other unrelated provisions have in the past, but the uncertainty makes long-term planning difficult for businesses.

As I have argued for years on the Hill, like-kind exchanges are a matter of tax timing and not a permanent deferral of taxes They give businesses in need of cash flow the strategic ability to determine when it is best to recognize gain and pay taxes associated with the disposal of capital assets.

Should Congress repeal like-kind exchanges, and provide for 100% expensing for five years, what will your company’s financial position be by 2024? Tax obligations will be high (states are not likely to adopt 100% expensing), there is no offset from capital expenditures, and the cost of debt, assuming the trend continues, will slowly cripple economic gain realized in prior years.

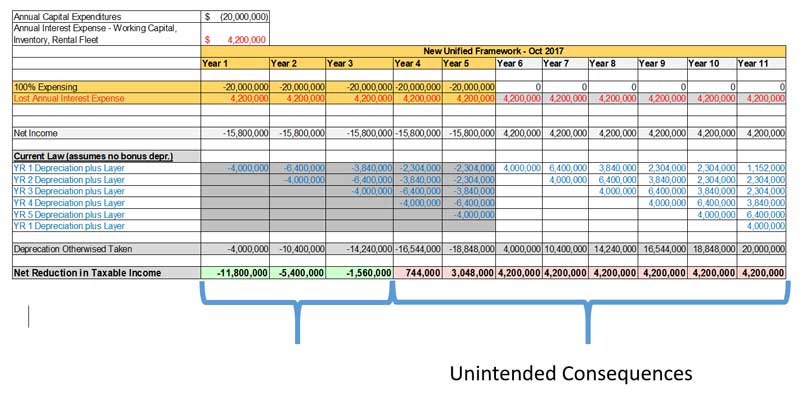

As illustrated in this table, immediate expensing increases cash flow for only three years under the proposed outline. In the fourth year, companies will begin to recognize significant increases in tax obligations. Should like-kind exchanges also be repealed, studies show that business will begin to contract – not expand -- in an environment in which cash flow is restricted.

Let your state and federal representatives know that immediate expensing not a fair trade for repeal of like-kind exchanges. Your company relies on clients’ access to low cost debt, the ability to exchange assets (allowable under IRC 1031 like-kind exchanges), and incentives to deal in the secondary and tertiary markets. 100% expensing most likely would not include used equipment. This is not the way to grow our economy.