BLOG

Invest in Your Business Infrastructure Today, Don’t Wait for Tomorrow

In today’s market with inflation at a multi-decade high and escalating interest rates many businesses want to “wait and see”, rather than “adapt and act”. We believe if you aren’t moving forward, you are moving backwards, and now is the perfect time to reinvest into your business and improve your 1031 exchange infrastructure – if you don’t, know that others will.

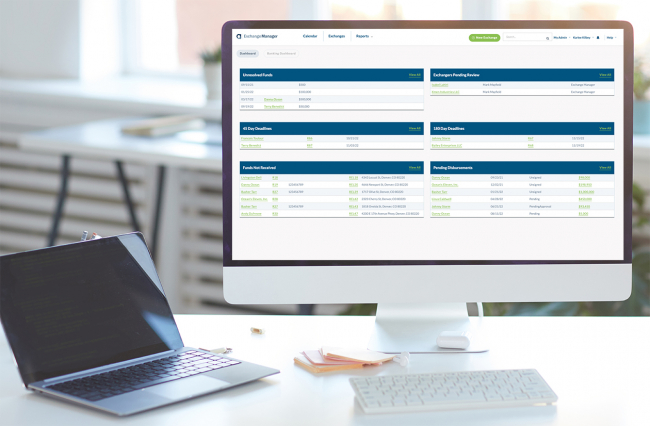

Exchange Manager ProSM, the only patented 1031 exchange web-enabled workflow, is proving its worth time and time again as Qualified Intermediaries (QI) across the country continue to license and implement the software in their own organizations.

Features of Exchange Manager ProSM include:

- Standardized workflow with embedded controls to ensure exchange compliance

- Single data entry to reduce data redundancies and potential for errors

- Automated document creation and execution

- Calendar-view of all exchanges, with automated reminders to ensure timeliness

- Central repository for all exchange documents with robust reporting options

Exchange Manager ProSM QI clients are experiencing the following since implementing the revolutionary 1031 workflow technology:

- 30-50% reduction in time spent on mundane, tedious administrative tasks

- Increased efficiencies with up to 35% reduction in processing times

- Reduced operating expense by replacing costly and typically antiquated software programs including client databases, electronic signature applications, and file storage systems

Exchange Manager ProSM delivers on the expectations of today’s exchanger, including real-time access to exchange data, timely completion of requests, and the ability to handle last minute closings without skipping a beat. As a QI, don’t just meet, but strive to exceed these elevated expectations, Exchange Manager ProSM makes that possible.

With 2023 just around the corner and the first quarter being the most active for 1031 exchanges historically, now is the time to act on improving and scaling your QI processes.