BLOG

The IRS Announces Tax Relief for California Taxpayers Impacted by Wildfires

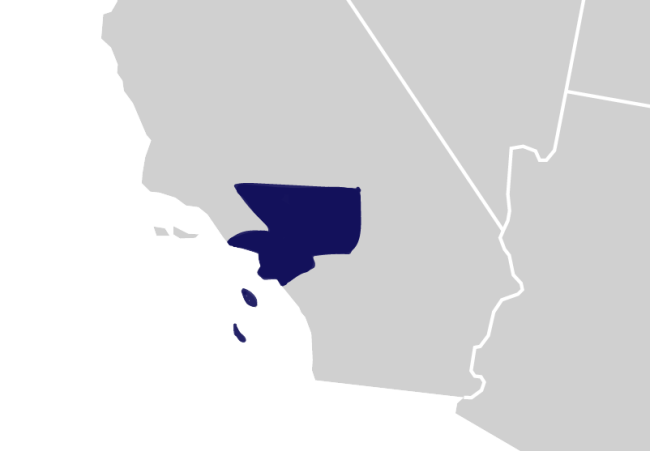

Due to California wildfires, the IRS has issued Tax Relief for Los Angeles County.

Affected Taxpayers have until October 15, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Los Angeles County qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an "Affected Taxpayer"?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

Visit for full details on the tax relief for Los Angeles wildfires.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.