BLOG

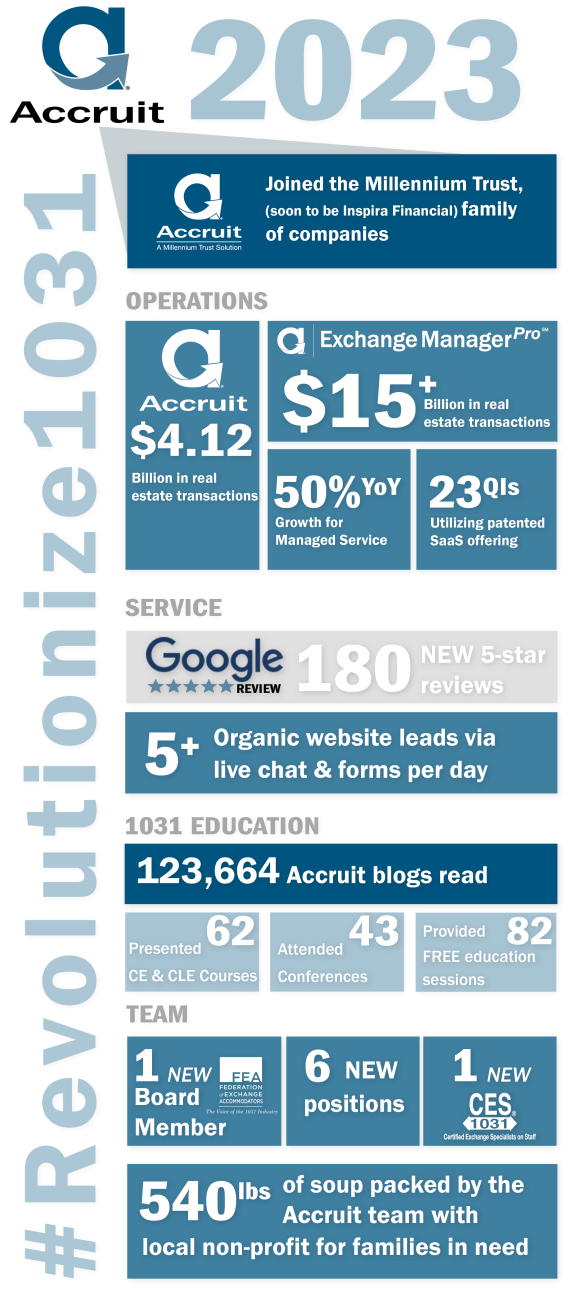

A Year In Review: 2023

2023 was a year of unknowns for much of the real estate industry and adjacent industries like 1031 Exchange Qualified Intermediaries. With interest rates reaching a 20 year high, recession, inflation, all while real estate prices held steady and high - it was a challenging market for many.

Accruit's team didn't let these factors impact their goals for growth and innovation. It was a great 2023 and Accruit's team couldn't be more proud of the results.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.