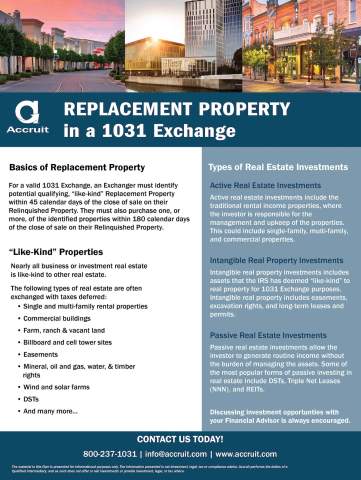

Replacement Property in a 1031 Exchange

Image

For a valid 1031 Exchange, an Exchanger must identify potential qualifying, “like-kind” Replacement Property within 45 calendar days of the close of sale on their Relinquished Property. They must also purchase one, or more, of the identified properties within 180 calendar days of the close of sale on their Relinquished Property.

There are misconceptions that "like-kind" means you much exchange an apartment building for another apartment building, that is not case. Nearly all business or investment use real estate is "like-kind" to one another. This flyer provides a deeper look into the Replacement Property, as well as the different types of real estate investments including active and passive.