BLOG

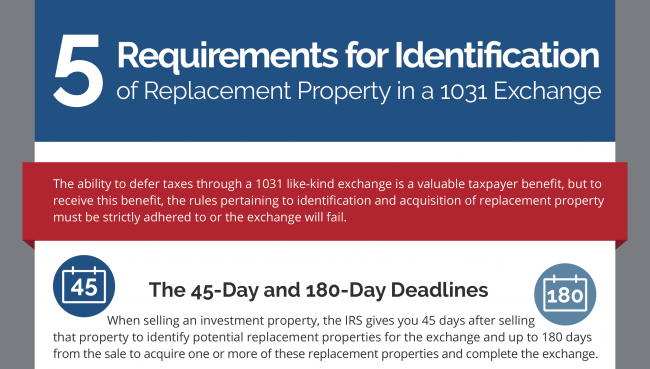

Infographic: Requirements for Identification of Replacement Property in a 1031 Exchange

The ability to defer taxes through a 1031 like-kind exchange is a valuable taxpayer benefit, but to

receive this benefit, the rules pertaining to identification and acquisition of replacement property

must be strictly adhered to or the exchange will fail.

The ability to defer taxes through a 1031 like-kind exchange is a valuable taxpayer benefit, but to receive this benefit, the rules pertaining to identification and acquisition of replacement property must be strictly adhered to or the exchange will fail.

This infographic describes the deadlines and rules for identification of 1031 replacement property:

· The 45-day and 180-day deadlines

· The 3-property rule

· The 200% rule

· The 95% rule

View the full infographic or click the image below.

Updated 5/31/2022.