BLOG

What is Net Investment Income Tax?

Section 1031 Exchanges, also known as Like-Kind Exchanges, are among the most powerful tax planning tools available to real estate investors. A properly structured 1031 exchange can potentially defer four levels of taxes – federal capital gains tax, federal depreciation recapture tax, state tax, and net investment income tax. While most people understand capital gains and depreciation recapture taxes, there is some level of confusion regarding the net investment income tax.

Net Investment Income Tax Overview

The Net Investment Income Tax came about as part of the Health Care and Education Reconciliation Act of 2010, amending the Affordable Care Act, sometimes called “Obamacare Act”, effective as of January 1, 2013.

Net investment income tax is tax that applies to only to Net Investment Income. In general, Net Investment Income (NII) includes interest, dividends, capital gains, rent and royalty income, and other items specifically outlined in IRC Section 1411. Gains from the sale of stocks, bonds, mutual funds, investment real estate, interests in partnerships and S corporations, along with capital gains from mutual fund distributions are also included in NII.

Wages, unemployment compensation, Social Security benefits, alimony, tax-exempt interest, self-employment income and other items outlined in Section 1411 are specifically excluded from NII. NII also does not include any amount that is covered by the statutory exclusion under Section 121 related to the sale of a primary residence, which excludes the first $250,000 of gain recognized on the sale of a residence by an individual, or $250,000 in the case of a married couple.

Who Pays Net Investment Income Tax?

The Net Investment Income Tax (“NIIT”) is 3.8% applied to the net investment income of individuals, estate, and trusts that have income above limits set by the statute.

When the investor owns their real estate in a single-member limited liability company (LLC), that LLC is usually treated as a disregarded entity for income tax purposes. Thus, the investment income is reflected on the individual’s personal income tax return, and remains subject to the NIIT. However, multi-member LLCs are treated as partnerships for income tax purposes, and the distributions of the partnership’s business income are typically treated as self-employment income, which is exempt from the NIIT.

How is Net Investment Income Tax Calculated?

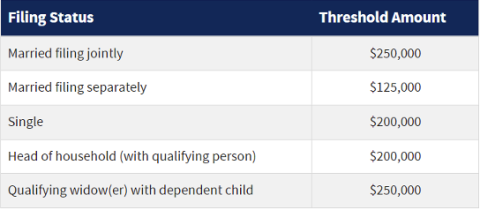

Individuals and married couples who have net investment income, will owe NIIT if their modified adjusted gross income is above these limits:

It is recommended that you review any tax related information with your tax and/or legal counsel to determine whether the NIIT applies to your specific situation.

For purposes of the NIIT, modified adjusted gross income (MAGI) is the taxpayer’s adjusted gross income (Form 1040, Line 37) increased by the amounts of certain specified deductions or other exclusions. A shorthand analysis would be that if an individual reports income over $200,000 on their tax return, or a married couple reports income over $250,000, the NIIT probably impacts them.

A couple of examples may assist in understanding the application of the NIIT:

- Taxpayer, a single filer, has wages of $180,000 and $15,000 of dividends and capital gains. Taxpayer’s modified adjusted gross income is $195,000, which is less than the $200,000 statutory threshold. This Taxpayer is not subject to the Net Investment Income Tax.

- Taxpayer, a single filer, has $180,000 of wages. Taxpayer also received $90,000 from a passive partnership interest, which is considered NII. Taxpayer’s modified adjusted gross income is $270,000. Taxpayer’s modified adjusted gross income exceeds the threshold of $200,000 for single taxpayers by $70,000. Taxpayer owes NIIT of $2,660 ($70,000 x 3.8%).

As always, taxpayers are encouraged to discuss their plans with their tax and legal advisors before they embark on the path toward the sale of an investment or business use property, and to engage the services of a Qualified Intermediary, such as Accruit, before the first closing that will effectively start their 1031 Exchange.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.