What is a 1031 Exchange?

1031 exchange is one of the most popular tax strategies available when selling and buying real estate “held for productive use in a trade or business or investment”. A 1031 exchange, also called a like-kind exchange, LKE, Starker Trust, or tax-deferred exchange, was first authorized in 1921 when Congress recognized the importance of encouraging reinvestment in business assets. Today, taxpayers use 1031 exchanges to increase cash flow by deferring taxes on gains realized through the sale of real estate, as long as they reinvest those gains in the replacement property. In practical terms, a taxpayer sells a property used for business or investment to exchange for another property also for use in business or investment. When transacting an exchange, the taxpayer never receives nor controls the funds from the sale of their relinquished property. The funds are directly used to purchase the replacement property. Because the taxpayer never actually gains the proceeds from the sale, they may defer the tax they would pay if they simply sold a property and kept the money.

Eligibility for 1031 Exchanges

Section 1031 of the tax code allows property owners to defer taxes on the sale of their real estate held for business or investment purposes. The only requirement for a person or entity to be eligible for an exchange is that it is a US tax-paying identity. All taxpayers qualify individuals, partnerships, limited liability companies, S corporations, C corporations, and trusts. There are no citizenship requirements to an exchange, meaning that you are eligible for an exchange as long as you pay taxes to the US. This requirement includes DACA recipients or foreign companies. Keep in mind that the same taxpayer that sells the relinquished property must also purchase the replacement property. The same taxpayer requirement refers to tax identity, not necessarily the name on the property’s title. A taxpayer can preserve tax identity without holding title under their name by holding title under a “tax disregarded entity,” which is not considered separate from its owner for tax purposes. Entities such as a single-member LLC, a trustee of a revocable living trust, or a tenant in common are examples of a tax disregarded entity. Taxpayers may also hold title under a Delaware Statutory Trust (DST) or Illinois Type Land Trust beneficiary. The tax gain can be deferred if tax‐deferred exchange requirements are satisfied and the sale proceeds are reinvested in like‐kind property.

1031 Exchange Requirements

Properties Must Be Exchanged

By itself, a sale followed by a purchase does not qualify as a 1031 Exchange. Instead, the transaction must be treated as an exchange for tax purposes. To convert a sale followed by a purchase into an exchange, a property owner will employ a qualified intermediary (QI) who acts as a middleman to tie the sale to a buyer and the purchase from a seller as a verified exchange. The taxpayer must contact the QI before closing the initial sale in the case of a forward exchange or purchase in the case of a reverse exchange. To open an exchange, the QI will need your Exchange Documents, this includes:

- Contact Information for the taxpayer or main point of contact (phone, e-mail)

- Taxpayer Name and Address

- Tax ID Number

- Title Commitment

- Signed Sale Contract (including all addendums)

- Organizational Documents (if the property is not held in the name of the individual)

- After gathering all necessary documentation and Information, the QI will send an Exchange Agreement to sign and open the exchange.

Held for Business or Investment Purposes

Both the relinquished property and the replacement property must be held for business or investment purposes. Property used primarily for personal use as a primary residence does not qualify for like-kind exchange treatment. A sale of business property is not required to be replaced with other business property; it can be replaced with investment property or vice versa. Real estate held for business or investment purposes is not limited to office buildings. Many different types of real property can be used in an exchange. Agricultural assets such as farmland and ranches are eligible for exchange, vacant lots for land improvement, Delaware Statutory Trusts (DST), conservation easements, and even in many cases, vacation homes used as rental units can be exchanged. This requirement refers to the nature of the property rather than the form. The fact is you can buy any real property such as farm, ranch, apartment complex, commercial building, or rental home. The critical component of this requirement is that it is used for trade, investment, or business purposes.

No Constructive or Actual Receipt of Exchange Funds

The purpose of a like-kind exchange is to promote the continuity of investment and promote economic growth. It is a violation of the taxpayer or an agent for the taxpayer to receive exchange funds or for the taxpayer to directly or indirectly control the exchange funds during the exchange period. Restricting constructive or actual receipt of exchange funds is a critical rule for like-kind exchanges. The IRS allows for tax deferral on the money received in the sale of a property because the taxpayer never receives it. Because the taxpayer is not in receipt of any new funds, the IRS does not tax them on the sale of the property; those funds are used to purchase new real property, not for monetary gain. An exchange is not tax avoidance, and once the taxpayer sells their property without reinvesting and does realize the monetary gain from the sale of their asset, the IRS will collect all applicable taxes. It is important to note that an exchange cannot be opened after the close of a sale. Once a taxpayer has direct or indirect access to funds, an exchange can no longer be valid. In rare circumstances, early after a sale and a taxpayer wishes to reconstitute the sale as an exchange, they can attempt a rescission.

A common pitfall in exchange transactions is the early release of funds. The only time someone can terminate an exchange early is at the end of the 45-day identification period. If the taxpayer has not identified a single property by 45 days, they can close their exchange, and the funds can be disbursed. If the taxpayer has identified any property, funds must be held until the transaction is complete or at the end of the 180-day exchange period.

Learn more on our blogs:

1031 Exchange Time Limit & Identification Requirement

All safe-harbor exchanges have a time limit of 180 days, whether forward, reverse, build-to-suit, or improvement exchanges. The exchange period begins when the relinquished property sells in a forward exchange, and the QI holds the proceeds from the sale. A taxpayer must acquire or identify the target replacement property within 45 days after the transfer of the relinquished property. The replacement property must be identified in a written document, unambiguously described, signed by the taxpayer, and received by the qualified intermediary on or before the 45th day. If the taxpayer identifies replacement property within the designated period, the taxpayer has the remainder of the 180-days to acquire the replacement property. The timeline for a reverse exchange is the same. The taxpayer buys the replacement property first and then has 45 days to identify a property to sell. After the identification period, the taxpayer has 135 days to sell and close on their relinquished property.

In order for the taxable gain to be deferred, certain key requirements must be satisfied:

Properties Must Be “Like‐Kind”

One of the advantages of exchanging real estate is that almost all real property is considered like‐kind to all other real property. Since real estate must be exchanged for real estate, the rules provide that the words “like-kind” reference the nature or character of the property and not its class or quality. Like-kind is defined in the tax code quite liberally in that any real estate is like-kind to any other type of real estate. For example, whether the real estate is improved or unimproved is not significant. Many court cases and rulings have addressed the like-kind standard for real property. Regulations provide examples of like-kind real property, some of which are obvious, others less so.

Below are examples of real property interests that one can exchange for any other type of real estate:

- Commercial properties

- Multi-family rentals

- Vacant lots

- Single-family rentals

- Vacation rentals (Airbnb / VRBO)

- Farm and Ranchland

- Improvements on property not already owned

- Oil, gas, and other mineral interests

- Water rights

- Cell tower, billboard, and fiber optic cable easements

- Conservation easements

- Delaware Statutory Trusts (DST’s)

The regulation does require that replacement property be located within the same geographic location as the relinquished property. For a 1031 exchange, there are only two geographic locations, within the US and outside the US. For example, a taxpayer cannot use proceeds from a property in Ohio to acquire an investment property in Peru. Property within the US is only like-kind to other property within the US, and property outside of the US is only like-kind to other property outside the US.

Exchange Equal or Up in Value

To defer all taxable gain, a property owner must first reinvest all the equity in the relinquished property into the replacement property. Second, the purchase price of the property acquired must equal or exceed the sale price of the relinquished property. Typically, this requires debt on the new property to equal or exceed the debt paid off on the relinquished property. The net proceeds of the sale (i.e., the amount held in the exchange account) are used in full, and the taxpayer puts on equal or greater debt on the new property compared to the amount paid off at the time of closing on the sale. Another expression sometimes used is that the taxpayer should have “no net debt relief.” Any cash taken out at closing and any debt that is not covered could be subject to taxation. However, there are times when taxpayers wish to receive some cash out for various reasons. Any money generated from the sale that is not reinvested is referred to as “boot,” and the amount is taxable.

Rules Around the Identification & Replacement Property

The 3-Property Rule

The 3-property rule states that the replacement property identification during the initial 45 days of the exchange can be made for up to three properties regardless of their total value. After relinquishing their initial property, the taxpayer can identify and purchase up to three replacement properties. A qualified intermediary often requires that a taxpayer state how many replacement properties they intend to acquire to prevent common pitfalls surrounding the receipt of excess funds and the early release of funds.

The 200% Rule

If a taxpayer were to identify more than three properties, they could still have a valid exchange by following the 200% rule. The 200% rule states that a taxpayer may identify and close on numerous properties, so long as their combined fair market value does not exceed double the value of their relinquished property. Using the listing price is usually a safe way of determining a fair market value for a property.

The 95% Rule

If the taxpayer has overidentified both of the previous rules by identifying more than three properties, and their combined value being more than 200% of the relinquished property value, the 95% value comes into play. The 95% rule defines that identification can still be considered valid after breaking the first two rules if the taxpayer purchases through the exchange at least 95% of what they identified.

Types of Exchanges

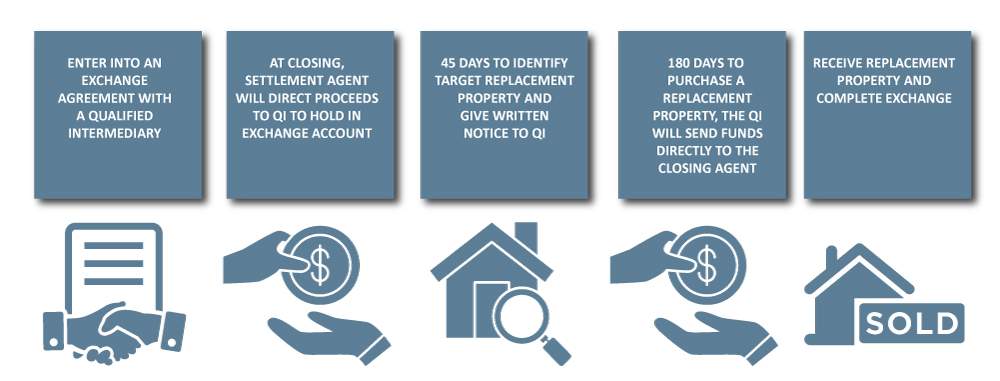

Forward or Deferred 1031 Exchange

In a forward 1031 exchange, the taxpayer and the qualified intermediary (QI) set up an exchange agreement before any sales transaction. The taxpayer assigns their rights to sell the relinquished property to the QI. The QI will act as the seller of the property and hold the funds in an exchange account for benefit of the taxpayer. The taxpayer has the first 45 days of the exchange to identify potential replacement property. Once a replacement property is selected, the rights to acquire that property are assigned to the QI. The taxpayer must close no later than 180 days after the closing of the relinquished property. After negotiating the price and executing a purchase contract with the seller of the replacement property, the taxpayer will assign the rights to purchase the replacement property to the QI. The funds held in the exchange account are sent directly to the closing agent, the taxpayer will receive their tax-deferred property and finalize their exchange.

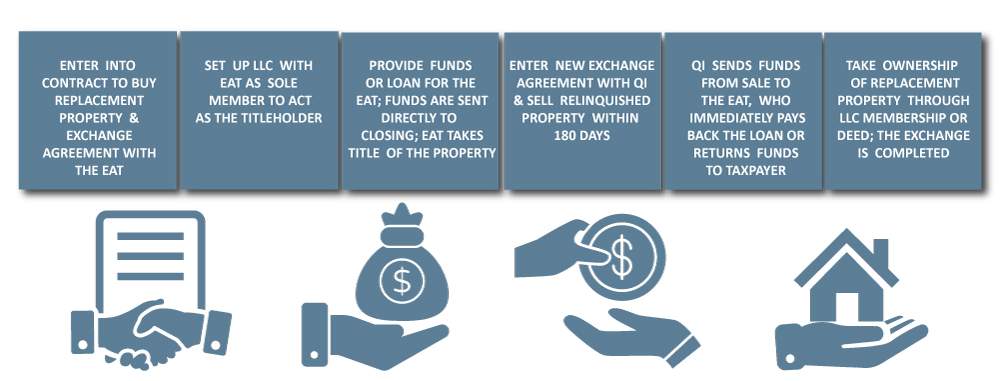

Reverse 1031 Exchange

A reverse exchange, also referred to as a parking exchange, occurs when taxpayers purchase their replacement property before selling their relinquished property. When the exchange company services a forward exchange, it acts as a qualified intermediary (QI). When an exchange company services a reverse exchange, it takes title of a property (primarily the replacement property) through a specially created entity, usually a single-member LLC. It is referred to as an exchange accommodation titleholder (EAT). The taxpayer first enters a contract to purchase the replacement property and then enters a reverse exchange agreement with the entity acting as the EAT. If the taxpayer is not providing all necessary funds to buy the replacement property, they must select a bank to loan the funds required to purchase the replacement property to the EAT. The EAT takes title of the new property and “parks” or holds that title until the taxpayer sells the relinquished property as part of a conventional forward exchange. After selling the relinquished property, the QI holds and disperses the funds to the EAT to purchase the replacement property. The EAT takes those funds received and repays any financing made by the taxpayer. Lastly, the taxpayer takes ownership of the replacement property.

Build-to-Suit or Improvement 1031 Exchange

Taxpayers sometimes need to acquire a property they desire to construct improvements or complete renovations that they wish to include as part of their exchange replacement property. Improvements on land a taxpayer has already acquired will not count as replacement property in a 1031 tax-deferred exchange. By utilizing a build-to-suit, improvement, or construction exchange, it would be possible for a taxpayer to receive property that is improved to the taxpayer’s specifications in a tax-deferred exchange. When an exchange involves replacement (new) property that is land to be constructed upon or a structure requiring improvements, a build-to-suit or a property improvement exchange will allow for the inclusion of the improvement costs in the exchange value of the replacement property. These exchanges can take place as forward or reverse exchanges. For example, in a forward improvement or construction exchange, 1031 proceeds from the relinquished property sale are received and held by the qualified intermediary (QI) under a tax-deferred exchange agreement and the related assignment agreement. Under a separate qualified exchange accommodation agreement (QEAA) and related documents entered into between the taxpayer and the exchange accommodation titleholder (EAT), the 1031 proceeds are then used by the EAT to purchase the property requiring the improvements. Within the 180 days after the relinquished property sale, improvements may be constructed while the replacement property is parked with the EAT. Exchange proceeds may be used to fund the upgrades through draw requests submitted by the taxpayer to the QI and the EAT. Suppose there are insufficient exchange funds for the purchase and the desired improvements. In that case, the taxpayer may provide additional funds to the EAT or secure a loan to provide the necessary funds. In a safe-harbor transaction, the improved replacement property is transferred from the EAT to the taxpayer within 180 days after the relinquished property sale.

Non-safe Harbor

Accruit provides all types of complex parking transactions. The referred to safe harbors of an exchange are the guidelines set forth by the Internal Revenue Code. They are a set of rules and a process that must be followed to guarantee a valid exchange. A Non-Safe Harbor (NSH) exchange does not provide the taxpayer with the certainty of a safe harbor structure should the transaction be audited. NSH transactions are much rarer as they are more complicated and entail more risk to the QI. By definition, a Non-Safe Harbor (NSH) Parking Transaction takes longer than 180 days to close. Like a Safe Harbor Parking transaction, a taxpayer can complete a NSH Improvement, NSH Build to Suit, NSH Parking of the relinquished property, or NSH Parking of the Replacement property.

How to get an Exchange Started

Contact Accruit

Contact Accruit by calling 800-237-1031 or emailing info@accruit.com to start an exchange and obtain a forward exchange document package. Exchange document package includes items listed below.

Gather Exchange Document - This includes:

- Contact Information for the taxpayer or main point of contact (phone, e-mail)

- Taxpayer Name and Address

- Tax ID Number

- Title Commitment

- Signed Sale Contract (including all addendums)

- Organizational Documents (if the property is not held in the name of the individual)

- After gathering all necessary documentation and Information, the QI will send an Exchange Agreement to sign and open the exchange. Complete all blanks in the Exchange Agreement, the Qualified Escrow Agreement, and the W-9

Setting your Exchange up for Success

Following the guidelines for an exchange can become difficult from time to time. A taxpayer may not be able to identify a suitable property to buy in the 45-day identification period. A taxpayer may not be able to sell their property within 180 days. Improvements on a property may take longer than 180 days. Once a safe harbor provision is not met, the exchange is no longer eligible for tax deferment.

It’s important to consider all the facts before starting your exchange, consider current market conditions, and address any lending issues you may encounter.

Here are a few other ways of setting yourself up for a successful exchange:

- If you want to begin a forward exchange, start looking for your replacement property as early as possible.

- You can stretch out this extra period by delaying the close date on your relinquished property, preventing your 45-day countdown from starting.

- If you have already identified a property you would like to purchase but have not been able to sell your current property, consider a reverse exchange. That way, you will ensure your purchase and have 180 days to sell the old property.

- To avoid unwanted delays that may cut your 1031 exchange timeline short, ensure that your financing is in order before entering into an exchange agreement.

Financial Benefits of Leveraging 1031 Exchange

The purpose of a 1031 exchange from its beginning 100 years ago is to ensure the continuity of investment, and those benefits span across the entire economy. Real estate investors have come to know the full value of a 1031 exchange on the deferral of taxes on gains and depreciation recapture. A 1031 exchange aims to feel like a sale transaction never took place. The following example will help illustrate the benefits.

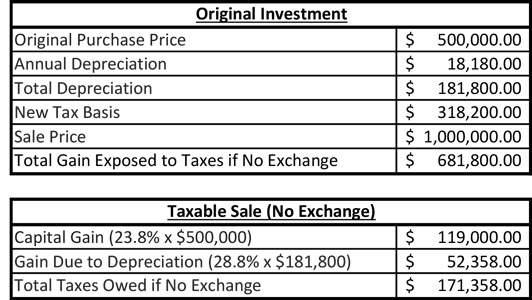

A taxpayer purchases River Rentals, a multi-unit rental property for $500,000 and takes annual depreciation deductions for the next ten years, reducing his tax basis to $318,200. The taxpayer decides to sell the property at the market value of $1,000,000 to consider a different investment, potentially real estate.

This investor realized a taxable event of $171,358 through the sale of their property. Should the investor have pursued a 1031 exchange they would have deferred those taxes and had a larger principal amount to reinvest. The importance of the deferral is to work in favor of the investor for compounding returns.

Through an exchange the investor would be able to reinvest the full $1,000,000. At a 7% compounded rate of return over 10 more years that equates to nearly doubling the investment again to $1,967,151. Without an exchange the post taxable sale principal would only be $828,642 ($1,000,000 - $171,358).

With a 7% compound return on the post taxable sale principal over 10 years the investor would end up with $1,630,064, a full $337,087 less than if they had exchanged and not sold. A post taxable sale investment would have to earn 21% more over 10 years or nearly 2% more each year to catch up with the 1031 exchange investment.

In a world of lower returns, it's smart to leverage 1031 exchange to defer taxes and allow compounding of interest to work in the investors favor.

Read more on depreciation in our blog: What are my 1031 Exchange Depreciation Options?

Other 1031 Exchange Considerations

1031 Exchange vesting issues –Partnership Drop and Swap

Can a partner or member trade their share of a property interest upon sale? One of the most common questions asked of a qualified intermediary involves the situation in which one or more members or partners in a limited liability company (LLC) or partnership wish to execute a1031 exchange and others simply want to cash out. Because section 1031 provides that property must belike-kind to each other, there are several difficulties to structuring an exchange that allows members to go their separate ways.

The most common technique involves redeeming the member’s interest and is generally referred to as a “drop and swap.”A1031 tax exchange drop and swap can take place in several different ways. When most members wish to cash out, the taxpayer can transfer his membership interest back to the LLC in consideration of his receipt of a deed for a percentage fee interest in the property equivalent to his former membership interest. At that point, the taxpayer would own a tenant in common (TIC) interest in the relinquished property together with the LLC. At closing, each would provide their deed to the buyer, and the former member can direct his share of the net proceeds to a qualified intermediary. There are times when most members wish to complete an exchange, and one or more minority members want to cash out. The drop and swap can still be used in this instance by dropping applicable percentages of the property to the existing members. At the same time, the limited liability company completes an exchange at the LLC level, and the former members cash out and pay the taxes due.

Read more on the details on our blog: 1031 Drop and Swap out of a Partnership or LLC

Selling Expenses

When selling or purchasing an investment property in a 1031 exchange, certain selling expenses paid out of the sales or 1031 exchange proceeds will result in a taxable event for the exchanger. Routine selling expenses such as broker commissions or title closing fees will not create a tax liability. Operating expenses paid at closing from 1031 proceeds will generate a tax liability for the exchanger.

Allowable closing expenses include:

- Real estate broker’s commissions, finder, or referral fees

- Owner’s title insurance premiums

- Attorney or tax advisor fees related to the sale or the purchase of the property

- Closing agent fees (title, escrow, or attorney closing fees)

- Recording and filing fees, documentary, or transfer tax fee

Taxable Closing expenses include:

- Pro-rated rents

- Security deposits

- Utility payments

- Property taxes and insurance

- Association’s dues

- Repairs and maintenance costs

- Insurance premiums

- Loan acquisition fees

Learn more on how to reduce these taxable consequences: What are Valid 1031 Exchange Selling Expenses

Cash Out Refinance Before or After a 1031 Exchange?

Most taxpayers wish to defer tax in full when completing a 1031 exchange. One simple rule of thumb is that the taxpayer must trade “up or equal” in value to accomplish this. At times taxpayers wish to receive some cash out for various reasons. Any cash generated at the time of the sale that is not reinvested is referred to as “boot” and is fully taxable. There are a couple of possible ways to gain access to that cash while still receiving full tax deferral. When trying to generate some cash around the time of selling relinquished property, it may seem like a good idea to refinance right before an exchange. It would leave you with money in pocket, higher debt, and lower equity in the replacement property, all while deferring taxation. Except, the IRS does not look favorably upon these actions. It is, in a sense, cheating because by adding a few extra steps, the taxpayer can receive what would become exchange funds and still exchange a property, which is not allowed. Certain situations may lessen the IRS’ scrutiny of these actions. There is no bright-line safe harbor for this, but at the very least, if it is done somewhat before listing the property, that fact would be helpful. The other consideration that comes up a lot in IRS cases is independent business reasons for the refinance. Maybe the taxpayer’s business is having cash flow problems. Perhaps the property needs a new roof or other repairs.

In general, the more time elapses between any cash-out refinance, and the property’s eventual sale is in the taxpayer’s best interest. For those that would still like to exchange their property and receive cash, there is another option. The IRS does allow for refinancing on replacement properties. The American Bar Association Section on Taxation reviewed the issue. It concluded that once a taxpayer owns replacement property and refinances it, incurring a repayment obligation, that taxpayer is in no different position than anyone else owning property and refinancing it.

Seller Financing in a 1031 Exchange

In a 1031 exchange, there are methods to facilitate seller financing of the relinquished property sale without running afoul of the 1031 exchange rules. In a sale of real estate, it’s common for the seller, the taxpayer in a 1031 exchange, to receive money down from the buyer in the sale and carry a note for the additional sum due. The taxpayer facilitates financing for the buyer in this way to make the transaction happen. Sometimes this arrangement is entered into because both parties wish to close, but the buyer’s conventional financing takes longer than expected. Suppose the buyer can procure the funding from the institutional lender before the taxpayer closes on their replacement property. In that case, the note may simply be substituted for cash from the buyer’s loan. When this is not the case, and the taxpayer will not receive funds in the exchange account before the end of their 180-day exchange period, the solution is a note buyout. The taxpayer will advance funds of their own into the exchange account to “buy” their note. The funds can be personal cash that is readily available or a loan the taxpayer takes out. The buyout allows the taxpayer to receive fully tax-deferred payments in the future and still acquire their desired replacement property within their exchange window. Keep in mind that regulations prohibit the taxpayer from the “right to receive money or other property pursuant to the security or guaranty arrangement,” it is probably better to receive the cash into the account sometime before the purchase of the replacement property while assigning the note to the seller after all the replacement property has been acquired.

Frequently Asked Questions

A Qualified Intermediary, or QI, is an unrelated third party or used to facilitate the 1031 exchange transaction. For more information about selecting a QI, see our article entitled How to Choose a Qualified Intermediary.

The IRS has extended 45-day identification period and the 180-day exchange period for taxpayers impacted by the pandemic. For more details, see Deadline Extension for 1031 Exchanges due to COVID-19.

The identification rules in a 1031 exchange include the following: The 45-day requirement to designate replacement property The 3-property rule The 200-percent rule The 95-percent rule The incidental property rule Description of Replacement Property Property to be produced For more information, see our blog post: What are the Rules for Identification and Receipt of Replacement Property in an IRC 1031 Tax Deferred Exchange?

One of the most common questions asked of a qualified intermediary involves the situation in which one or more members or partners in a limited liability company (LLC) or partnership wish to effect a 1031 exchange and others simply wish to cash out. While there are multiple ways to structure transactions allowing various members to effectively trade their interest, by far the most common technique is for the outgoing member to have the LLC redeem the member’s interest and to convey by deed the applicable percentage interest in the property equivalent to the member’s former share. The transfer to the member and the subsequent trade by that person is generally referred to as a “drop and swap.” Read more about drop and swaps in our post, 1031 Drop and Swap out of a Partnership or LLC

The difference between 1031 and 1033 exchanges: section 1033 is tax deferral specific to the loss of property by a taxpayer and is therefore is referred to as an involutary conversion. Section 1031 is the voluntary replacement of either real or personal property in an exchange of business or investment assets. Finally, while Section 1031 generally requires the use of a qualified intermediary, Section 1033 does not.

The 45 day rule refers to the period a taxpayer has to identify replacement property from the date of sale. According to exchange regulations: “The identification period begins on the date the taxpayer transfers the relinquished property and ends at midnight on the 45th day thereafter.” The identification must (i) appear in a written document, (ii) signed by the taxpayer and (iii) be delivered to the replacement property seller or any other person that is not a disqualified person who is involved in the exchange.

For more information, see our blog post: What are the Rules for Identification and Receipt of Replacement Property in an IRC 1031 Tax Deferred Exchange?

Allowable closing expenses for 1031 exchange purposes are: Real estate broker’s commissions, finder or referral fees Owner’s title insurance premiums Closing agent fees (title, escrow or attorney closing fees) Attorney or tax advisor fees related to the sale or the purchase of the property Recording and filing fees, documentary or transfer tax fees Closing expenses which result in a taxable event are: Pro-rated rents Security deposits Utility payments Property taxes and insurance Associations dues Repairs and maintenance costs Insurance premiums Loan acquisition fees: points, appraisals, mortgage insurance, lenders title insurance, inspections and other loan processing fees and costs For more information about allowable closing expenses, see What are Valid 1031 Exchange Selling Expenses?

Taxpayers sometimes wish to generate some cash on or around the time of selling relinquished property as the first leg of an exchange. Any sums paid to the taxpayer at closing are subject to taxation. As an alternative, a taxpayer may wish to refinance the relinquished property before the exchange or refinance the replacement property after the exchange. However, in the absence of mitigating factors, refinancing the relinquished property is generally discouraged. See Cash Out Refinance Before or After a 1031 Exchange? for more information

In situations where the relinquished property sells for a greater value than the replacement property, it is possible for construction or improvement costs to reduce the taxable amount. Read Can Property Improvement Costs Be Part of a 1031 Tax Deferred Exchange? for an in-depth explanation of build-to-suit and property improvement exchanges.

In situations where the buyer's financing is taking more time than expected, this can be an attractive alternative. However, in a 1031 exchange, seller financing requires the use of a Qualified Intermediary, and careful attention to timing. We've described this in more detail in Seller Financing in a 1031 Tax-Deferred Exchange.

The IRS Code does not allow members/partners to do his or her own exchange, only the entity can do so. Given enough preplanning, there is a technique referred to as a “drop & swap” whereby certain members/partners can drop their interest from the entity and enter into the exchange individually and not at a member/partner.

No, in order to fully shelter the gain, the sale price of the relinquished property, net of closing costs must be reinvested. Another way to look at this is that the net amount going into the exchange account must be reinvested and there has to be equal or greater mortgage debt on the new property compared to what was paid off upon closing of the old property.

Under the regulations there are quite a few options to deal with holding the money from the sale. Some do not require putting the money with the QI although that is generally the easiest and most convenient. The real reason a taxpayer has to use a QI is, through the paperwork provided, use of a QI converts the transaction of the sale of a property and the later purchase of a new property to an exchange of the one for the other.

No, there is no requirement under the regulations that the counterparty needs to sign receipt of the notice of assignment. Rather the only requirement is that the other party needs to receive the notice of the assignment. Receipt for it may be a common courtesy but it does not harm the exchange if the party prefers not to sign for that notice.

No, an exchange is a like kind exchange of real estate for other real estate. Incidental costs such as paying loan related fees do not constitute the direct payment for like kind real estate.

To pay such fees out of an exchange account, the fee needs to meet two pronged criteria. First, the fee has to related only to legal services pertaining to the sale and/or purchase. The second one is that the type of payment must be one that is typically found on a closing statement in the locale where the property transaction takes place.

Yes, the Regulations require that all parties to the contract have to receive notice of the assignment by the taxpayer of his/her interest. So should there be other parties selling or buying with the taxpayer, those parties must get the notice as well as the party on the opposite side.

No, the Regulations provide that any party to the exchange can be the necessary recipient of the notice. So, for example if the contract with the seller of the new property contains a reference in the contract stating that this is the replacement property for the buyer’s exchange, that would be sufficient.

No, this is a misconception. The two year curative provision only applies if the related parties are exchanging directly with one another. This is seldom the case. In a situation where the taxpayer sells the relinquished property to a third party and acquires and holds replacement property for an excess of two years from the related party, that is not sufficient to meet the rule.

No, the purpose of adding the related party rules to the Tax Code was to prevent taxpayers from manipulating the tax result by buying replacement property from a related party such as a subsidiary company. That so called tax abuse is not applicable when a party is selling the relinquished property to a related party.

Yes, the related party rules to not necessarily include all relatives. Rather they disallow persons that are descendants or one another. Lineal descendants such as Parent, child, grandparents, siblings are considered related for this purpose, not so for in laws, aunts, uncles, cousins, etc.

No, the Reverse Exchange Rev. Proc. is very taxpayer friendly and relations between the Accommodator and taxpayer do not have to be arm’s length. Typically, the Accommodator will Master Lease the property to the taxpayer enabling the taxpayer to manage the property, collect the rent and pay for expenses.

No, effective with the current changes to the Tax Code made beginning with the year 2018, only real estate can be the subject of an exchange. As a result, personal property such as a business or franchise cannot be the subject of exchanges.

While there is nothing in the Regulations on this question, for technical reasons it is considered bad practice to refinance in anticipation of entering into an exchange. By doing so, it changes the amounts on cash and debt that would need to be applied to the replacement property acquisition and it is tantamount to “gaming the system”. Refinancing after an exchange to pull some equity out does not have these issues and is considered proper.

Yes, that does not cause any issues since the exchange rules do not come into play until the time the relinquished property is transferred. At that time neither the taxpayer nor his/her agent should be holding onto exchange funds.

The primary purpose of a Settlement Statement on a commercial transaction is to let the buyer and seller see how the amount they have to pay, or the amount received was calculated. As a legal matter it is not required by any exchange rules. However, in different jurisdictions settlement agents have the practice of refereeing the Qualified Intermediary and/or having it sign the Settlement Statement.

Yes, but there are some challenges. If a taxpayer is selling on an installment basis, to the extent that the majority of the purchase price is payable beyond the 180-day exchange period, the taxpayer can only get deferral if he/she advances the amount into the replacement property even though it may not be received for a period of years. A buyer can but under an installment contract and the balance that is carried by the seller is treated like any other debt, such as a new loan by a bank lender.

Yes, same answer as above. The seller would have to advance the sum being financed into the replacement property. Later receipt of that principal sum from the buyer would be tax deferred. Interest paid during that period would be taxable.

Some costs that pertain closely to the sale of the property such as commissions, title insurance fees, closing fees, recording fees, transfer taxes, etc. can come out of the proceeds before the net amount is sent to the Qualified Intermediary.

As a rule of thumb, it is generally easier to park the replacement property. However, when the taxpayer has financing set up for the replacement property that the lender will not allow to be in the name of the Accommodator, this cannot be done. There may be other reasons as well such as known environmental issues on the replacement property.

Yes, many people think if they are doing a reverse exchange, that is an alterative in lieu of the reverse exchange. That is not correct. The only thing a reverse exchange does is to allow the taxpayer to effectively control the replacement property when the corresponding relinquished property cannot be sold first. A forward exchange is still necessary to actually exchange the old property for the new property.

The default is that the payment of the tax is treated as an installment and payable in the year in which the funds were able to be paid out. Should a particular taxpayer wish to pay it in the first year to take advantage of tax losses in that year or for other reasons that can be done by a special election.

No, this is a common problem. Since for exchange purposes a taxpayer has to roll over all the net cash, the amount of the loan should be for the remainder of the purchase price.

The IRS issued a ruling years ago that said for purpose of the Accommodator’s role in holing and transferring reverse exchange property, it could be considered the agent of the taxpayer and as a result extra transfer taxes did not need to be paid. There are a few states that still require payment regardless of the IRS ruling.

The IRS rules allow the taxpayer to lend the necessary funds to the Accommodator, but just like a bank lending funds, those funds are typically provided directly to the settlement agent and do not need to come to and through the Accommodator.